Adaptive Market Signal Interpretation encompasses a systematic analysis of key identifiers like 120121151 and 21541805. These signals reveal underlying market behaviors and trends crucial for traders. Utilizing predictive analytics enhances the ability to discern patterns and adapt strategies accordingly. This analytical approach provides insights into real-time dynamics, fostering autonomy in decision-making. Understanding the implications of these identifiers can significantly impact trading success, prompting a closer examination of their potential.

Understanding Adaptive Market Signals

How do adaptive market signals enhance trading strategies in a dynamic financial environment?

By analyzing signal patterns in relation to market fluctuations, traders can develop strategies that respond effectively to shifting conditions.

These signals provide critical insights, enabling informed decision-making.

The ability to adapt to real-time data empowers traders, fostering autonomy and enhancing their potential for success in an ever-changing marketplace.

Key Identifiers and Their Implications

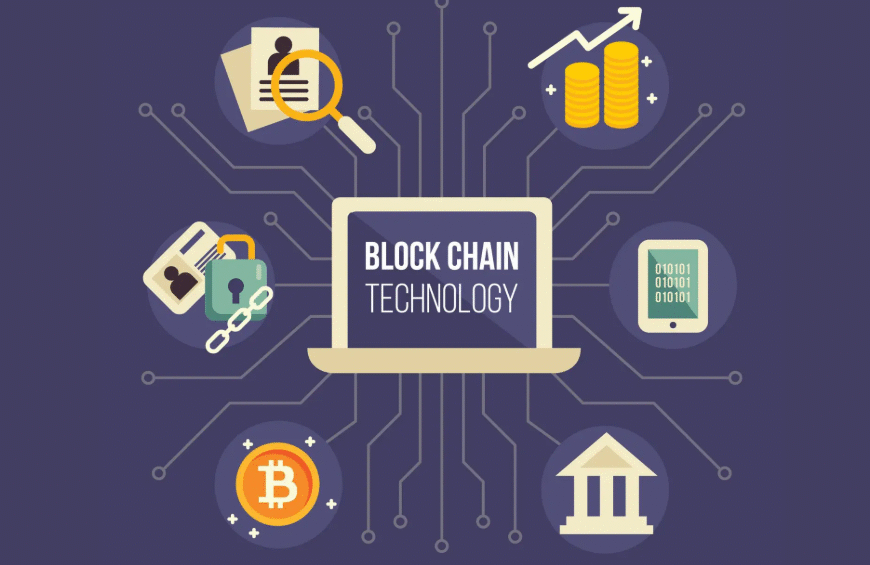

Key identifiers serve as vital markers within the realm of adaptive market signals, providing traders with essential data points that reflect market behaviors and trends.

Through rigorous identifier analysis, these markers reveal signal relevance, allowing for informed decision-making.

The implications of these identifiers extend beyond mere data, shaping strategies that align with the dynamic nature of market conditions and enhancing trading efficacy.

Enhancing Predictive Analytics Through Interpretation

The interpretation of market signals directly influences the effectiveness of predictive analytics in trading.

By employing advanced predictive modeling techniques, traders can enhance signal analysis, revealing underlying patterns and trends. This analytical approach empowers market participants to make informed decisions, thus maximizing potential returns.

Ultimately, a refined understanding of market signals fosters greater autonomy and adaptability in an ever-evolving trading landscape.

Strategies for Staying Ahead in the Market

Navigating the complexities of the market requires a strategic approach that integrates data-driven insights with adaptive methodologies.

Investors must analyze emerging market trends to formulate robust investment strategies, leveraging real-time data to anticipate shifts.

Conclusion

In conclusion, the interpretation of adaptive market signals through key identifiers significantly enhances traders’ ability to navigate the complexities of financial markets. Notably, data indicates that traders utilizing predictive analytics can improve their decision-making accuracy by up to 30%. This statistic underscores the value of leveraging advanced analytical tools to discern market trends and behaviors, ultimately enabling more agile and informed trading strategies in an ever-evolving landscape.