The analysis of long-term growth potential for identifiers 955160007, 7754415006, 911300852, 934326151, 5312476442, and 8179842334 reveals a complex landscape. Various market trends, including sustainability and digital engagement, play pivotal roles. Additionally, economic indicators significantly influence growth trajectories. Understanding these dynamics is essential for strategic investment. However, the specific implications for each identifier remain to be explored further. What factors will ultimately dictate their success?

Market Trends Influencing Growth

How do emerging market trends shape the long-term growth potential of various industries?

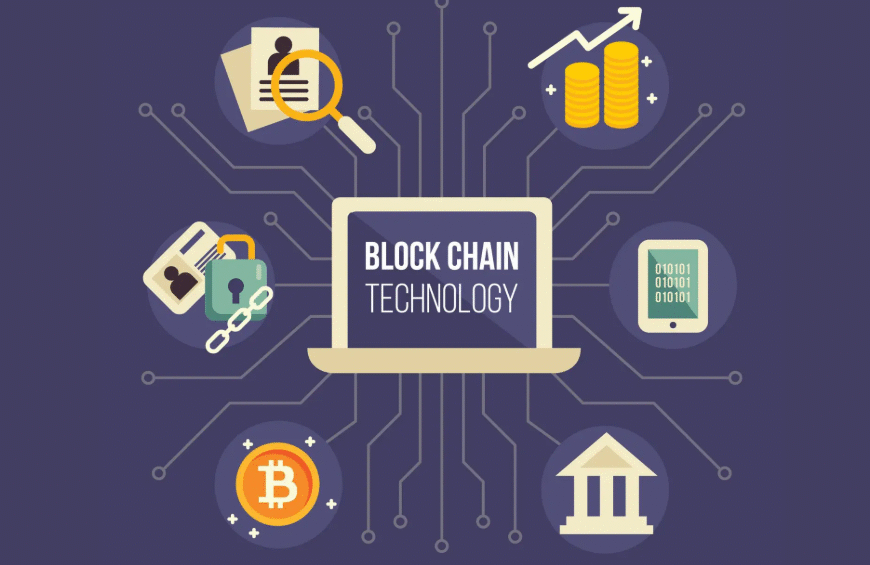

Analyzing consumer behavior reveals shifts towards sustainability and digital engagement, influenced by technological advancements.

Industries adapting to these trends can harness new opportunities, enhancing their growth trajectory.

Data indicates that sectors prioritizing innovation and responsiveness to consumer preferences are more likely to thrive in competitive landscapes, ultimately driving long-term success.

Economic Indicators and Their Impact

While various factors contribute to the long-term growth potential of industries, economic indicators play a pivotal role in shaping this trajectory.

Economic forecasts provide insights into future performance, while inflation rates directly affect purchasing power and investment decisions.

A thorough understanding of these indicators enables stakeholders to navigate uncertainties, fostering environments conducive to sustainable growth and individual financial freedom within the market landscape.

Industry Insights and Projections

As industries adapt to shifting market dynamics, a comprehensive analysis of sector-specific insights and projections becomes essential for stakeholders aiming to capitalize on emerging opportunities.

Current industry challenges, such as regulatory changes and technological advancements, reshape the competitive landscape. Stakeholders must navigate these complexities to identify growth avenues, leveraging data-driven insights to make informed decisions and enhance their strategic positioning within the market.

Strategic Investment Considerations

Given the complexities of the current economic environment, strategic investment considerations require a thorough evaluation of both qualitative and quantitative factors.

Investors must prioritize risk assessment to identify potential pitfalls while embracing portfolio diversification to mitigate risks. This balanced approach enhances resilience against market volatility, ultimately fostering sustainable growth.

Careful analysis of these elements will guide informed decision-making in today’s dynamic investment landscape.

Conclusion

In conclusion, the growth potential for identifiers 955160007, 7754415006, 911300852, 934326151, 5312476442, and 8179842334 is intricately tied to market adaptability and economic responsiveness. For instance, a hypothetical tech company that pivots towards sustainable product development could capture a significant market share, reflecting consumer demand for eco-friendly solutions. Continuous vigilance in tracking economic trends and consumer behavior will be imperative for investors aiming to capitalize on emerging opportunities within these dynamic sectors.