The Market Behavior Diagnostic Summary presents essential identifiers such as 8556148530 and 6154692789, which serve as benchmarks for evaluating market dynamics. By scrutinizing these performance metrics, stakeholders can uncover significant trends and fluctuations that impact consumer behavior. Understanding these indicators is vital for assessing market health. However, the implications of these findings extend beyond mere analysis, suggesting a deeper exploration into investment strategies and market sentiment. What further insights await?

Overview of Key Market Identifiers

Market identifiers serve as critical metrics that provide insight into the dynamics of a given marketplace.

These identifiers, including key performance indicators and sector performance metrics, illuminate underlying trends and competitive positioning.

Analyzing Trends and Fluctuations

Trends and fluctuations within various industries provide critical insights into consumer behavior and economic conditions.

Conducting trend analysis reveals fluctuation patterns that inform strategic decision-making. By examining data points over time, analysts uncover underlying factors influencing market dynamics.

Such insights empower stakeholders to navigate uncertainties, adapt strategies, and capitalize on emerging opportunities, ultimately fostering a sense of autonomy in an ever-evolving marketplace.

Market Sentiment and Its Implications

Understanding market sentiment is crucial, as it serves as a barometer for investor confidence and consumer behavior.

Bullish sentiment typically correlates with rising market indices, signaling optimism among traders. Conversely, bearish trends reflect pessimism, often resulting in declines.

Analyzing these sentiments quantitatively can provide insights into potential market movements, enabling investors to gauge risks and opportunities effectively in a dynamic financial landscape.

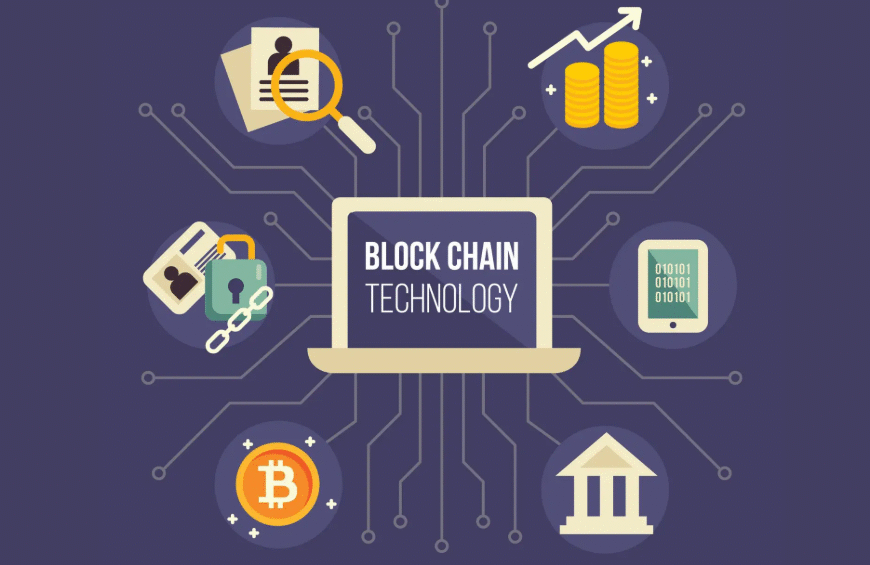

Enhancing Investment Strategies Through Data Insights

Leveraging data insights can significantly enhance investment strategies by providing a clearer picture of market dynamics and investor behavior.

By utilizing predictive analytics, investors can make data-driven decisions that foresee market trends and shifts. This analytical approach fosters informed choices, minimizing risks and maximizing potential returns.

Ultimately, it empowers investors to navigate the complexities of market fluctuations with greater confidence and autonomy.

Conclusion

In conclusion, the Market Behavior Diagnostic Summary provides crucial insights through its identified metrics, enabling stakeholders to navigate market complexities. For instance, a hypothetical investor analyzing the trends associated with identifier 8556148530 could discover emerging consumer preferences, prompting strategic shifts in product offerings. This data-driven approach not only enhances competitive positioning but also fosters informed decision-making, ultimately leading to improved investment outcomes in a dynamic marketplace. Such analytical rigor is essential for sustaining long-term growth and profitability.