Market structure signal assessment relies on distinct identifiers, such as 5107474557 and 987491298, to uncover market trends and behaviors. These identifiers serve as critical tools for traders aiming to identify anomalies and patterns. By scrutinizing their implications, investors can refine strategies and enhance risk management. However, the true depth of these signals and their potential impact on investment outcomes warrants further exploration. What insights might emerge from a closer examination?

Understanding Market Structure Signals

A fundamental understanding of market structure signals is essential for discerning the behavior of financial markets.

Market signal interpretation enables traders to identify trends and possible reversals, providing insights into price movements.

Accurate trend identification allows for informed decision-making, facilitating strategic entry and exit points.

Analyzing Unique Identifiers in Market Trends

How can unique identifiers enhance the understanding of market trends?

By analyzing identifier patterns, analysts can discern underlying trends and anomalies within market data. This trend analysis allows for the identification of consistent behaviors and irregularities, leading to more informed decisions.

Recognizing these patterns empowers stakeholders to navigate market fluctuations with greater clarity, thereby enhancing strategic planning and promoting an environment of informed freedom in investment choices.

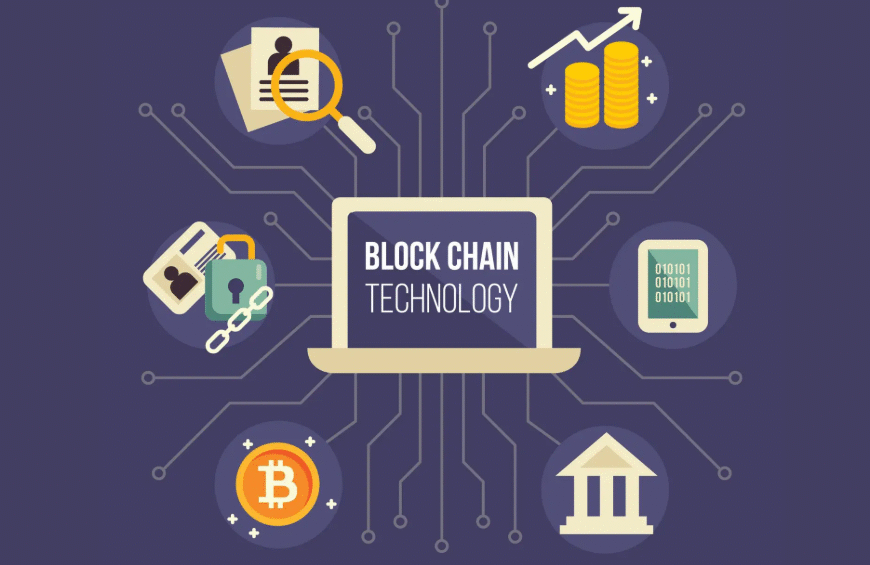

Implications of Market Indicators on Investment Strategies

Market indicators serve as critical benchmarks that can significantly influence investment strategies.

By accurately interpreting these signals, investors can optimize strategies to manage investment risk amid market volatility. The reliability of these signals is essential for effective trend forecasting, as it influences data interpretation.

Ultimately, understanding market indicators allows for informed decision-making, enhancing the potential for profitable investments while navigating inherent market uncertainties.

Case Studies: Real-World Applications of Market Signal Assessment

While many investors rely on theoretical frameworks for decision-making, real-world applications of market signal assessment provide valuable insights into the practical implications of these indicators.

Case studies illustrate how effective signal interpretation can identify market anomalies, allowing investors to capitalize on opportunities previously overlooked.

Such analyses demonstrate the necessity of integrating empirical evidence with theoretical models for informed, strategic investment choices.

Conclusion

In the grand circus of market trading, where numbers pirouette and identifiers juggle trends, one might wonder if the true secret lies in deciphering these cryptic signals or simply flipping a coin. Yet, as our diligent analysts unravel the mystique behind 5107474557 and its companions, it becomes evident that informed decision-making trumps chance. Ultimately, while fortune may favor the bold, a keen understanding of market structure signals is the tightrope that keeps investors from tumbling into chaos.